tax liens in georgia list

Appling County Tax Commissioner. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

3882 BLUE GRANITE WAY.

. Signup Now To Get a 1 Trial. Search Any Address 2. Cash cashiers check ACH or bank wire transfer.

Free Course Teaches How To Find Invest Buy Tax Lien Homes In Your Area. This is the searchable electronic filing submission docket as provided for by Georgia Code 15-6-973 and is effective January 1 2018. Ad Understand How Tax Liens Deeds Work In Free Online Course.

However Georgia has many tax deed sales. If you do not see a tax lien in Georgia GA or property that suits you at this time subscribe to our email alerts and we will update you as new Georgia. A tax lien is a claim or encumbrance placed on a property that authorizes the Tax Commissioner or the Sheriff to take whatever action is necessary and allowed by law to obtain overdue taxes.

Content updated daily for state tax lien georgia. Within the state the Georgia Department of Revenue places tax liens also called state tax executions on delinquent taxpayers properties. County Tax Commissioners Sec.

Judicial Tax Sale List Currently Not Scheduled Contact Information. Georgia Tax Lien Laws are such that your obligation to pay your property taxes is back by the real estate itself. If your property taxes are not paid in full by January 1st then the county tax commissioner automatically gains a lien on your property.

In Georgia the tax collector or treasurer will sell Georgia hybrid tax deeds to the winning bidders at the delinquent property tax sale. Ad Looking for state tax lien georgia. There are more than 5804 tax liens currently on the market.

Judicial Tax Sale List. Property Taxes. Athens - Clarke County Tax Commissioner.

Appling County 86 Baldwin County 66 Banks County 31 Barrow County 42 Bartow County 9 Ben Hill County 46. Type Any Name Search Risk-Free. 8 rows Georgia currently has 38083 tax liens available as of August 17.

This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of superior court. The process is a little more complicated than in some states. Buying tax liens at auctions direct or at other sales can turn out to be awesome investments.

15 043 05 010. This lien leads to a tax sale auction in Georiga unless you pay the back taxes in full which dissolves the tax lien. 20 penalty of the amount for the first year or fraction of a year and 10.

Fast Easy Access To Millions Of Records. Just remember each state has its own bidding process. Federal tax liens are attached by the Internal Revenue Service IRS.

Athens - Clarke County. Ad Search Information On Liens Possible Owners Location Estimated Value Comps More. 48-4-3 Interest Rate.

According to the US. Personal checks business checks 3rd party checks money orders and debitcredit cards will not be accepted if the property has been scheduled for tax sale. 69 Tippins St Suite 102 Baxley GA 31513.

Tax Deeds Hybrid Sec. Get the Latest Foreclosed Homes For Sale. Smart homebuyers and savvy.

4028 WILLIAM MARY CT. Once scheduled for a tax sale only the following forms of payment are accepted. Treasurys annual report the IRS filed 543604 tax lien notices in 2019.

All payments are to be made payable to DeKalb County Tax Commissioner. State tax executions are conducted per the Revenue and Taxation laws. In Georgia tax deed sales have a right of redemption that pays 20 if the owner redeems the tax deed within one year.

Ad Register for Instant Access to Our Database of Nationwide Foreclosed Homes For Sale. WILLIAMS BEN SHERMAN HIS ESTATE PERS REP. Ad See Anyones Public Records All States.

Select a county below and start searching. For real property the Tax Commissioner must issue a 30-day notice to the property owner. 222 W Oglethorpe Ave 107 Savannah Georgia 31401 912 652-7100 912 652-7101.

Judicial Tax Sale List Currently Not Scheduled Judicial Tax Sale Photo List. 325 East Washington St Suite 250 Athens GA 30601. Phone 912367-8105 Fax 912367-5210.

Georgia does not sell tax lien certificates. It is also the first step in taking the property to tax sale. See Available Property Records Liens Owner Info More.

Foreclosures and Delinquent Taxes. Check your Georgia tax liens rules.

Amazon Com Georgia Real Estate Tax Lien Investing For Beginners Secrets To Find Finance Buying Tax Deed Tax Lien Properties 9781951929091 Blank Greene Mahoney Brian Books

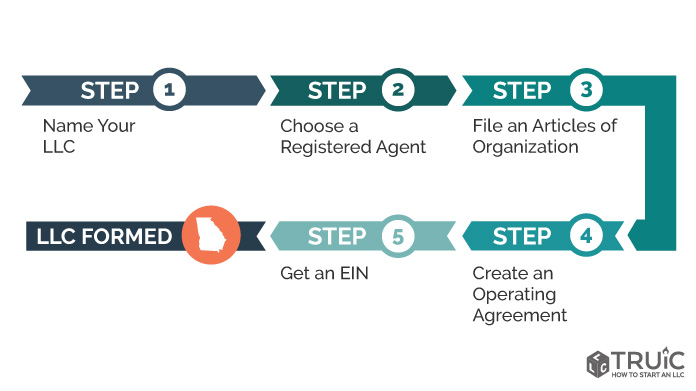

How To Set Up A Real Estate Llc In Georgia Truic

Tax Sale Lists You Can Buy Online And By Mail

![]()

Tax Sale List 09 06 2022 Troup County Tax Commissioner

Purchasing A Tax Lien In Georgia Brian Douglas Law

Tax Sale Lists You Can Buy Online And By Mail

Amazon Com Georgia Real Estate Tax Lien Investing For Beginners Secrets To Find Finance Buying Tax Deed Tax Lien Properties 9781951929091 Blank Greene Mahoney Brian Books

Free Georgia Bill Of Sale Form Pdf Word Template Legaltemplates

Georgia Real Estate Tax Lien Investing For Beginners Secrets To Find Finance Buying Tax Deed Tax Lien Properties 9781951929091 Blank Greene Mahoney Brian Books Amazon Com

What Are The Different Types Of Property Liens

What Happens During The Georgia Probate Process Breyer Home Buyers